GameStop (GME) token has captured the attention of many crypto enthusiasts and meme coin investors, especially those interested in the gaming community and blockchain-based projects. This blog provides an in-depth look at GME’s price history, its current market standing, and expert gamestop price prediction for the years 2025, and 2030. By exploring technical analysis, market trends, and trading tools, we aim to equip you with the knowledge needed to make informed decisions about the potential of the GameStop token.

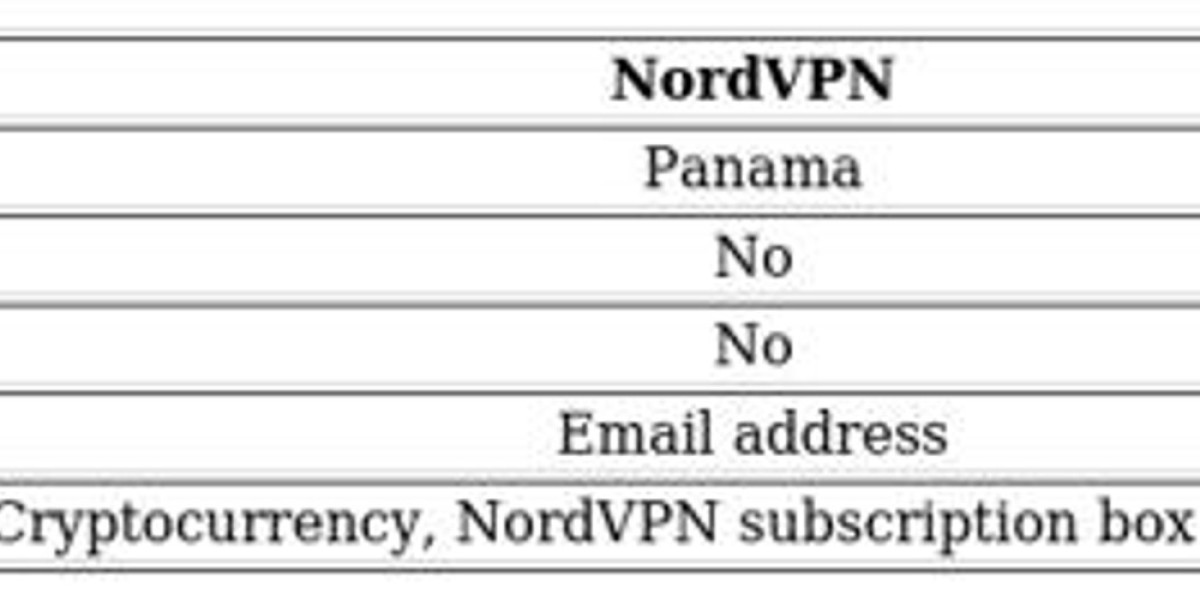

1. Overview of GameStop (GME) Token

GameStop (GME) is a meme coin built on the Solana blockchain network, inspired by the iconic gaming retailer GameStop. Unlike traditional cryptocurrencies, GME’s performance is tightly linked to the gaming industry and the developments surrounding the GameStop company itself. This unique connection often causes GME’s price to fluctuate in response to real-world gaming and stock market events, making it a highly dynamic token.

Currently, GME is trading at a price of approximately $0.000045, with a circulating supply of nearly 6.9 billion tokens and a market capitalization of about $112 million. The token has garnered significant trading volume, with daily activity reaching over $2 million, largely driven by meme coin enthusiasts and short-term traders.

GME is available on both centralized and decentralized exchanges, with Raydium being the primary platform for trading. Other exchanges such as MEXC, CoinEx, and Bitget also support GME, providing multiple avenues for investors and traders to access the token.

2. GME Price History and Current Market Dynamics

The GME token has seen both highs and lows, reflecting the volatile nature of meme coins. Its price movements are often influenced by technical patterns such as support and resistance levels, which traders use to forecast future trends. These technical indicators are essential for anyone aiming to predict the token’s price over different time horizons—from daily to yearly.

Recent price history shows GME has passed important resistance levels, with some analysts noting the potential to breach higher thresholds if momentum continues. The interplay between speculative trading and genuine interest from the gaming community fuels GME’s price behavior, making it crucial for traders to stay updated with both blockchain developments and gaming industry news.

3. GameStop (GME) Price Prediction for 2025

Looking ahead to 2025, projections show a mixed picture. On the downside, GME could dip to as low as $0.0001, indicating a potential loss in value. On the upside, however, the token may reach a peak price of $0.020. The average price forecast stands at approximately $0.0015.

This volatility underscores the importance of timing in trading GME. The token may offer lucrative opportunities during price spikes, but the risk of holding through downturns is considerable. Traders should employ tools such as price charts, technical indicators, and pattern analysis to make timely decisions.

| Year | Expected Price (Min) | Expected Price (Max) | Expected Price (Avg) |

|---|---|---|---|

| 2025 | $0.0001 | $0.020 | $0.0015 |

4. GameStop (GME) Price Prediction for 2030

The long-term outlook for GME until 2030 suggests a pattern of gradual decline interspersed with occasional sharp price spikes. These spikes are likely linked to renewed interest when GameStop’s parent company or stock gains media attention. Between these surges, trading volume and liquidity may decrease significantly, leading to higher price volatility.

Technically, the minimum expected price by 2030 could fall as low as $0.00001, with the maximum reaching $0.030 during favorable market conditions. The average price is projected to be around $0.0005.

| Year | Expected Price (Min) | Expected Price (Max) | Expected Price (Avg) |

|---|---|---|---|

| 2030 | $0.00001 | $0.030 | $0.0005 |

5. GME Price Chart Insights

Analyzing the GME price charts over different time frames (1-day, 1-week, 1-month, and 1-year) reveals the token’s volatile nature. Short-term charts often show sudden price jumps, while longer-term charts highlight the fluctuating trends and cycles. These charts are invaluable tools for traders to identify entry and exit points, set stop-loss orders, and develop comprehensive trading strategies.

6. Is GameStop (GME) Token a Good Buy Now?

Considering the volatile and risky nature of GME as a meme coin, it is generally better suited for short-term traders rather than long-term investors. The token’s price can surge quickly, offering opportunities for significant profits if timed correctly. However, these surges are often followed by declines, making holding GME over the long term potentially unprofitable.

Traders interested in GME should be prepared to monitor market trends closely and be ready to sell when the price peaks. Otherwise, they may face long periods of stagnation or loss. While the token is expected to remain active due to its strong ties to the gaming community and brand recognition, its value is unlikely to sustain long-term growth in a stable manner.

7. Conclusion

The future of GameStop (GME) token is marked by dynamic price action and significant volatility. Predictions for 2025 suggest promising growth, with opportunities for traders to capitalize on upward momentum. However, forecasts for 2025 and 2030 indicate a more cautious approach, with potential price declines punctuated by brief spikes.

For investors and traders alike, staying informed and using a variety of tools such as price charts, technical indicators, and support/resistance analysis is crucial. These tools help anticipate market moves and optimize trading strategies in the ever-changing landscape of meme coins like GME.

Ultimately, GME offers a fascinating case study of a token straddling the worlds of cryptocurrency and the gaming industry. While it holds potential for short-term gains, the inherent risks require careful management and a clear understanding of market dynamics. Proceed with caution, remain vigilant, and leverage all available data to navigate the exciting but unpredictable journey of the GameStop token.

Would you like me to include detailed technical analysis charts or guidance on how to use trading tools for GME?